Economic growth consists of changes in social and material welfare of the society. Today, in modern circumstances, one of the main problems of economy is finding ways to deliver sustainable and high rate of economic growth.

Nowadays, Russia faces serious economic problems which can influence its economic and also the rate of economic growth. Instability of economic growth leads to the necessity of research of prospects for further development of the country by econometric model building which can show us the trends in macroeconomic indicators.

There are several steps by which we can build a multiple regression model which also shows us the dependence of gross domestic product of Russia from independent variables. Firstly, it is necessary to define independent factors which influence the growth of GDP rates. Moreover, there was an allocation of different statistical data of GDP rates in Russia and several available independent variables to build a multiple regression model. Secondly, in this research we analyzed the dynamic of GDP rates and independent variables in Russia. Finally, we try to build the regression model and to verify its feasibility by comparing real and estimated values of GDP.

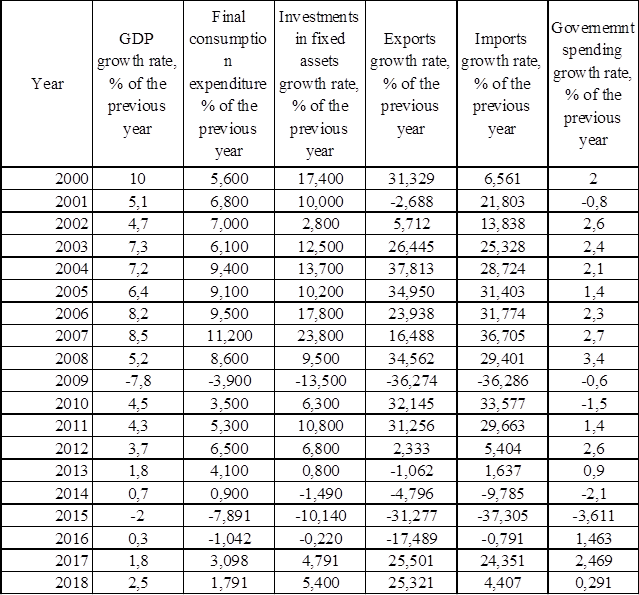

Actually, we examine the data from 2000 to 2018 to build our multiple regression model. The original data was taken from Federal State Statistic Service which is published on website https://gks.ru (Table 1).

Table 1

Original data to build regression model

Source: Federal State Statistic Service (link: https://gks.ru)

Actually, we choose several variables (factors) to build the regression model and to show the dependence of GDP.

Firstly, there are dependent variables: GDP growth rates (GDP growth rate in % of the previous year).

Secondly, there are independent variables: consumption growth rates, investment in fixed assets growth rate, exports growth rate, and government spending growth rate.

The description of the results is presented in Table 2.

Table 2

The main parameters of obtained regression model

|

|

Coefficient |

St. Error |

t-Statistic |

P-value |

|

Final consumption expenditure (X1) |

0,18698162 |

0,19693126 |

0,9494766 |

0,35969655 |

|

Investments (X2) |

0,36712201 |

0,08633911 |

4,25209404 |

0,00094352 |

|

Exports (X3) |

0,04231496 |

0,03022173 |

1,40015017 |

0,18488008 |

|

Imports (X4) |

-0,0366905 |

0,0425258 |

-0,8627821 |

0,40389355 |

|

Government spending (X5) |

-0,2429013 |

0,27015806 |

-0,8991083 |

0,38494652 |

Source: complied by the author

According to obtained results, the multiple linear regression model can be represented by the equation:

![]()

The verification of the statistical significance of the obtained multiple regression equation by Fisher F-criteria (checking the null hypothesis H0 about statistical insignificance of regression equation) shows such results: the actual value of F-criteria:

![]()

![]()

According to results, ![]() and the null hypothesis H0 about statistical insignificance of regression equation is rejected. Coefficients of obtained multiple regression is significant. Coefficient of determination (R2) is equal to 0,944. It means the part of variance of the dependent variable which is explained by obtained model, i.e. by explained variables.

and the null hypothesis H0 about statistical insignificance of regression equation is rejected. Coefficients of obtained multiple regression is significant. Coefficient of determination (R2) is equal to 0,944. It means the part of variance of the dependent variable which is explained by obtained model, i.e. by explained variables.

The graph of calculated (according to obtained model) and actual GDP growth rates from 2000 to 2018 is showed in Figure 1.

Figure 1. Actual and calculated growth rates of GDP in Russia

Source: complied by the author

The analysis of different periods in GDP (reduction and increase) with the comparison of them with economic policy of Russian government give us following results.

[2000-2002] In 2002 the growth of Russian economy was only 4,7%. It was less than initial forecasts of economists. Getting out the crisis, the Russian government have prepared special reforms (pension and tax reforms, including the flat rate of income tax, labor and budget codes). Moreover, in the nearest 2000, Russia started its negotiations to enter WTO and to establishing the custom Union.

[2002-2007] In a decade by 2008, the Russian GDP had almost doubled, the amount of the poorest people had halved, and foreign direct investment had increased from $14,3 billion in 2001 to $121,1 billion in 2007. Thus, the Russian currency had strengthened. The Russian government tried to strengthen the rubble by high inflation, however, it led to double-digit interest rates on loans. As a consequence, it forced the business to make cheap foreign loans. That dependence and currency risk had manifested during the 2008-2009.

[2008-2009] In 2008-2009, the fall in GDP growth from the peak pre-crisis level to the lowest level in 2009 (May) had exceeded 11%, net capital outflow in 2008-2009 had reached $200 billion, the dollar exchange rate had increased from $24,5/RUB to $35,7/RUB. In this case, the credit risks and risk of capital inflows reduction. As a consequence, there was a rapid decline in fixed capital investment. The crisis of working capital which had affected all sectors of Russian economy and had led to production decline. Investment and banking spheres, as well as financial markets, export and investment-oriented industries, – they all had escaped maximum damage.

[2009-2014] In spring of 2009, oil prices had begun to rise again, and the global economy had started to recover. After that, there was followed a recovery growth in Russia. After falling by 7,8% in 2009, the country’s GDP had increased by 4,5% in 2010, and then the growth had begun to fade, and even expensive oil could no longer support the economy. All in all, the world economy growth had been 3,8% (2010-2013). The deterioration of the external economic environment had led to drop in business profits, and the lack of resources severely had limited the ability to finance investment programs. As a consequence, in 2013 there was a falling of investment in fixed assets.

[2014-2018] In 2014, the Russian economy had faced serious problems. There were the falling in oil prices (from $115,2/bbl in June 2014 to $45,1 in January 2015, and to $27,5 in early 2016). The introduction of sanctions, the devaluation of rubble – all of this was the consequence of the annexation of Crimea. In 2014, the economy’s growth rate fell to 0,7% from 1,8% in 2013. There was a record outflow of capital, foreign direct investment collapsed to a minimum for the entire post-Soviet period. In 2015, the decline in GDP increased to 2,4%, and continued until the beginning 2016.

In 2017-2018, trying to accelerate the economic growth, Russian government started to use the budget funds. In 2018, there was developed national projects, increasing the VAT from 18% to 20%. Actually, it led to risks of inflation acceleration. Thus, the Central Bank stepped up monetary policy.

Despite the external similarity with crises in 1998 and 2008, the last downturn was much deeper and more complex. According to forecast of Ministry of Economic Development and Trade of the Russian Federation, from 2021 the economy’s growth rate will exceed 3%. However, a huge amount of economist think, that it will possible only in 2024-2025.

As a consequence of frustrate hopes, in Russia was formed a crisis of confidence to the government. According to the analysts of the World Bank, the only success of the authorities were the macroeconomic reforms (inflation targeting, stabilization of budget expenditures). However, there is a lack of budget resources due to the fact that government investment cannot replace the private ones. At a minimum, to stimulate private investment, the government should create the positive investment climate.

BIBLIOGRAPHY

1. Abel A., Bernarke B. Macroeconomics // A. Abel, B. Bernarke // Pearson Education – 2013 – 672 pages.

2. Aris B., Tkachev I. // Loong Read: 20 Years of Russia’s Economy Under Putin, in Numbers // The Moscow Times (Aug. 19, 2019).

3. Bazanova E. // Why has Russia not moved from stagnation to development in 20 years? // Vedomosti (Oct. 07, 2019).

4. Cooper W. // Russia’s Economic Performance and Policies and Their Implications for the United States // Congressional Research Service (Jun. 29, 2009).

5. King L. // Russia’s economic growth at 1.3% in 2019, slightly above expectations // Reuters (Febr. 3, 2020).

6. Kudrin A., Gurvich E. // A new growth model for the Russian economy // Russian Journal of Economics // Volume 1 // Issue 1// March 2015 // Pages 30-54.

7. Voskoboynikov I. // Sources of long run economic growth in Russia before and after the global financial crisis // Russian Journal of Economics // Volume 3 // Issue 4 // December 2017 // Pages 348-365.

8. The official website of Federal State Statistic Service (link: https://gks.ru).

9. The official website of the World Bank (link: https://data.worldbank.org).

10. Трегуб И.В. Прогнозирование экономических показателей на рынке дополнительных услуг сотовой связи. Финансовая акад. при Правительстве Российской Федерации, Каф. Мат. моделирование экономических процессов. Москва, 2009.

11. Трегуб И.В. Математические модели динамики экономических систем: монография – Москва: РУСАЙНС, 2018. – 164 с.

12. Трегуб И.В. Эконометрические исследования. Практические примеры. Econometric studies. Practical examples. – Москва: Лань, 2017. 164 с.

13. Tregub I.V. Econometrics. Model of real system. М.: 2016, 164 p.

14. Трегуб И.В. Эконометрика на английском языке Учебное пособие. М.: 2017