Introduction

Belgium, a

small and open economy of 11.4 million inhabitants, is located in the heart of

Europe. The economy benefits from a strong communication infrastructure and a

highly qualified workforce.

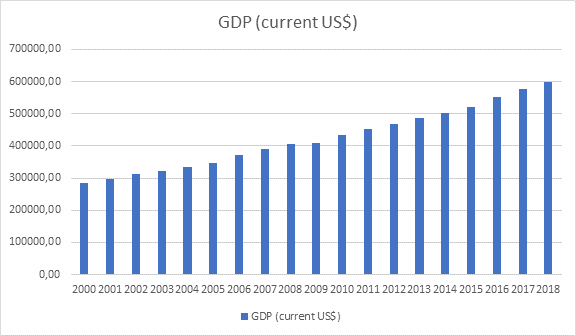

Real GDP

Growth data in Belgium is updated quarterly. Belgium’s GDP expanded 0.4 percent

on quarter in the three months to December 2018, the same as in the previous

period and in line with preliminary estimates. Household consumption (0.5

percent vs 0.7 percent in Q4) and gross fixed capital formation (0.1 percent vs

0.4 percent) slowed while government expenditure rose faster (1.1 percent vs

0.5 percent). Also, foreign demand contributed negatively to growth, as exports

rose 0.6 percent (vs -0.4 percent) and imports increased at a faster 0.9

percent (vs -0.3 percent). Year-on-year, the GDP advanced 1.2 percent, slowing

from a 1.6 percent expansion in the previous period and also matching earlier

estimates. It was the lowest annual GDP growth since Q2 2014. Considering 2018,

the economy advanced 1.4 percent, the least since 2013 and below a 1.5 percent

gain in 2017. So, the data reached an all-time high in 2018 and a record low in

2000 year.

Table

1 GDP – Belgium 2000-2018

Regression

analysis

A correlation

analysis was carried out of the relationship between the endogenous indicator,

which is understood in this case as the GDP and exogenous indicators from 2001

to 2018.

![]() – the endogenous parameter

– the endogenous parameter

(the GDP).

|

Year |

GDP |

|

2000 |

284933,00 |

|

2001 |

296257,00 |

|

2002 |

312900,00 |

|

2003 |

320613,00 |

|

2004 |

333831,00 |

|

2005 |

347658,00 |

|

2006 |

371464,00 |

|

2007 |

390526,00 |

|

2008 |

405729,00 |

|

2009 |

407955,00 |

|

2010 |

434371,00 |

|

2011 |

451933,00 |

|

2012 |

469720,00 |

|

2013 |

487344,00 |

|

2014 |

503620,00 |

|

2015 |

521018,00 |

|

2016 |

550989,00 |

|

2017 |

577535,00 |

|

2018 |

597433,00 |

Figure 1 – The data

for Y –the GDP in Belgium

We study the

main factors (variables) that affect the indicator of GDP. There are two exogenous

parameters in this model. GPD is the first to be taken with a lag. The lag is

one year.

![]() – the lagged GDP.

– the lagged GDP.

|

Year |

GDP |

|

2001 |

284933,00 |

|

2002 |

296257,00 |

|

2003 |

312900,00 |

|

2004 |

320613,00 |

|

2005 |

333831,00 |

|

2006 |

347658,00 |

|

2007 |

371464,00 |

|

2008 |

390526,00 |

|

2009 |

405729,00 |

|

2010 |

407955,00 |

|

2011 |

434371,00 |

|

2012 |

451933,00 |

|

2013 |

469720,00 |

|

2014 |

487344,00 |

|

2015 |

503620,00 |

|

2016 |

521018,00 |

|

2017 |

550989,00 |

|

2018 |

577535,00 |

Figure 2 – The data

for X1 – lagged GDP

The second

parameter for our model is the general government final consumption

expenditure.

![]() – the general government final

– the general government final

consumption expenditure.

|

Year |

General government spending (current US$) |

|

2001 |

12144,00 |

|

2002 |

11990,00 |

|

2003 |

12392,00 |

|

2004 |

12922,00 |

|

2005 |

12992,00 |

|

2006 |

13691,00 |

|

2007 |

17790,00 |

|

2008 |

19174,00 |

|

2009 |

20583,00 |

|

2010 |

21363,00 |

|

2011 |

22598,00 |

|

2012 |

23790,00 |

|

2013 |

24422,00 |

|

2014 |

24719,00 |

|

2015 |

24576,00 |

|

2016 |

25147,00 |

|

2017 |

25818,00 |

|

2018 |

26636,00 |

Figure 3 – The data

for X2 – general government final consumption expenditure

So, let’s

create the linear equation, by using the linear regression function in Excel to

calculate the coefficient for each exogenous parameter. In that case, it is

possible to estimate the relevance of the model.

Results

Our estimated

model is presented below.

![]()

Coefficient of

determination (R2adj) equals 0,995647526340896. This

means that around 99,7 % in changes of dependent variables are explained by

changes in independent variables by linear regression models.

F-test checks

non-randomness of R2 and equality of specification of a linear regression

model. From

calculations it was received, that Fcrit= 3,591530568 and F=1601,28084171368.

So, the

coefficient of determination is non-random and quality of specifications is

high.

Then need to

perform the T-test by comparing the T-statistics with the P-value. As can be

seen from Table 1, in the absolute value, the T-statistic is higher than the

P-value for all the considered coefficients. So, that is why our linear

regression coefficients are significant.

Table

1 – The data for T-test

|

T-statistic |

P-value |

|

-0,709631617 |

0,489583798 |

|

15,78776858 |

2,580811178 |

|

-1,068406623 |

0,303413885 |

Let’s check

the three conditions of the Gauss-Markov.

The first

condition of Gauss-Markov theorem is that average mean of residuals is equal to

zero. In order to check that, the average mean of residuals should be

calculated. As it can be seen from the residual table, the average mean of

residuals is nearly equal to zero, henсe the first condition of Gauss-Markov theorem is satisfied. This means,

that coefficients of the model are unbiased.

The

Goldfeld-Quandt test can be used to check the second Gauss-Markov condition.

This test checks the homoscedasticity in regression analyses. As it can be seen

from the table 2, Fcrit is higher than GQ and 1/GQ.

Table

2 – The Goldfeld-Quandt test calculation

|

GQ |

1,817679422 |

|

1/GQ |

0,550152017 |

|

FcritGQ |

6,094210926 |

In

order to verify the third Gauss-Markov condition, it is necessary to conduct

the Durbin-Watson Test. Based on the test results, it can be noted that the

Darbin-Watson value lies in the yellow zone between dl and du.

Based on it, we can conclude that there is no information about

autocorrelation.

The

adequacy of the model is checked throughout the construction of the confidence

interval. Based on the data from Table 3, we can conclude that the real value

lies between Y^– and Y^+, so, that is why

the model is adequate.

Table

3 – The Goldfeld-Quandt test calculation

|

Y^2018= |

605937,08 |

|

Y^–2018= |

592826,65 |

|

Y^+2018= |

605973,54 |

|

Y2018= |

597433,00 |

Finally,

the average approximation variance is equal 1,42%, mistake of

approximation is more than 25% that means that our model is inaccurate, so this

model is relevance for using.

References

1. Financial data. https://data.worldbank.org/ [Accessed 1 March 2020].

2. Data and statistic https://countryeconomy.com/ [Accessed 3 March 2020]

3. FOD Economic https://economie.fgov.be/ [Accessed 5 March 2020]

4. OECD Economic Surveys https://www.oecd.org/ [Accessed 3 March 2020]

5. Трегуб И.В. Прогнозирование

экономических показателей на рынке дополнительных услуг сотовой связи.

Финансовая акад. при Правительстве Российской Федерации, Каф. Мат. моделирование

экономических процессов. Москва, 2009.

6. Трегуб И.В. Математические модели

динамики экономических систем: монография – Москва: РУСАЙНС, 2018. – 164 с.

7. Трегуб И.В. Эконометрические

исследования. Практические

примеры. Econometric studies. Practical examples. – Москва: Лань, 2017. 164 с.

8. Tregub I.V. Econometrics.

Model of real system. М.: 2016, 164 p.

9. Трегуб И.В. Эконометрика на

английском языке Учебное пособие. М.: 2017